So…Why Is There Nothing on the Market?

For a generation who bought into the future of small stuffed animals whose hypothesized value was singularly dependent on their product tag never being bent or showing any sign of wear, quite literally how did so many of us fall for the torrent wave of hysteria that is cryptocurrency.

However, thinking back to what is the best example of purchasing swayed by group mentality, it has to be the Livestrong bracelet delirium of 2004. It seemed like all of a sudden everyone had a cheap bracelet on. The frenzy spiraled and that band of yellow plastic stood for your moral barometer, granted you social inclusivity, and meant you were in the group on the right side of the trend. By the time I joined in, they were sold out (or laughably marked up for resale) so I got one meant for a doll from build-a-bear and spent freshman year with no blood supply to my right wrist.

Pack mentality is playing a huge role in our real estate market, but instead of prompting hurried action, it’s instead ushering in an eerie standstill. While much of this is due to interests rates and the economy, a considerable portion of the problem is a gridlock between buyers and sellers, both afraid to be the first few to step out of the group holding pattern. While I know this is simplifying things and there are ample idiosyncrasies we’ll explore, much of the market can be contributed to hesitancy on both sides.

Buyers are waiting to see what others are going to do before jumping in themselves. Sellers are holding back seeing how comparable listings fair before officially entering the gauntlet. All the while prices are holding even, or even in some areas continuing to go up. So what gives?

Today we’ll cover the mentality of both buyers and sellers, how rates are effecting things, where the opportunities are, what needs to happen to get market momentum, and what that future market may look like.

Before going on further, I’m going to be speaking specifically to New York, which is its own very unique creature.

Unless you’ve been living under a rock, you should be painfully aware of the unstrained and unpredictable undulations of the last three years of the real estate market. 2020 is remembered for favorable levels of supply, desperate sellers, largely hesitant buyers, and a considerable number of transactions where buyers did quite well. 2021 took a turn in the second quarter where the dramatic dip of rates ushered in a surge of buyer activity that outpaced the number of properties coming on the market, resulting in dire competition and sizable price escalation. This sentiment held until late spring in 2022, during which the inventory was depleted, buyers were exhausted, sellers were irresponsibly emboldened, and rates began to climb. As buyers took a pause summer 2022, rates became unrecognizable so when buyers went to restart their search in the fall, they found their purchasing power to be gravely diminished and had to reassess what they could now afford and let go of what was possible previously. On the other side of the coin, sellers entered the fall 2022 market realizing they missed their window to sell in a feeding frenzy, as buyers activity had come to a hush and sellers had to engage every offer as there was no promise another would follow soon.

First, How We Got Here and what the Feds Did to the Housing Market

For everyone thinking prices will drop, sadly it’s not in the cards. The FED was and is the single most potent fueler of home price inflation as how they handled rates has caused incredible damage to the US housing markets. They kept rates so low for so long without recognizing the massive, unrealistic surges in home prices in many areas. Then, in 2022, they raised rates astronomically – and quickly – which triggered some grave consequences that will most likely result in further price escalation. Super-low rates for too long fueled unrealistic and excessive price gains, devouring inventory at an unprecedented rate at a time when there was a shortage of housing inventory already, thanks to a decade of under-building. Sharp rate hikes done rapidly have cut back home purchases dramatically, akin to a housing market depression. However prices have not come down much in most areas after massive surges, even with higher mortgage rates. The rapid Fed rate hikes have not allowed enough time to see the full effect of their hikes to take hold, and are now drying up credit markets which could strangle home building, at a time when markets are acutely under-supplied.

If the Fed’s mission is to curb inflation, their actions as it relates to housing costs are doing the exact opposite: in fact, they may be making things significantly worse over the long term.

1. As homes are in short supply, more people turn to renting, which further fuels rental costs.

2. Fewer homes built results in more competition which fuels pricing upwards. Only improved supply brings down pricing and the Fed’s actions are doing the exact opposite.

3. As rental returns surge, more investor-buyers eat up already low inventories leaving fewer options for buyers, that fuels pricing further.

4. If fewer people move due to high rates, lower supply keeps pricing up and rising.

The Impact of Interest Rates on Buyers and Sellers

To state the obvious, one of the biggest issues plaguing our market right now are interest rates. Buyers, particularly those who established their purchasing potential based upon rates in 2021, have been wrapping their heads around these higher monthly costs. While rates have slid a touch to the 5-6% range from January’s high, the difference from their lowest point in 2021 is quite meaningful for buyers.

Black Knight estimates 13.4 million homes nationwide have first mortgages with rates below 3%, while 20.9 million have loans with rates from 3% to 3.99%. Together, that accounts for about 65% of all U.S. homes with a first-lien mortgage. About 37% of homes in the US have no mortgage. Only about 4% of homes have first mortgages with rates of 6% and above. So riding on the coattails of those figures, it’s no surprise why so many sellers are hesitant to sell – if they’re financing, unless they are in desperate need for more space or a new location, the inflation of carrying costs has to be worth it. Which in a market defined by already lean inventory, it’s even more difficult to find a move worth justifying the surcharge in monthlies.

The Current Mentality of Both Buyers and Sellers

As previously mentioned, buyers still have a chip on their shoulder about how much mortgage payments have escalated, even though they are in a more favorably priced market with less competition where units are going for ask or under, not unanimously 10-20% over. Because of the lack of inventory, buyers right now don’t have the luxury of seeing 15-20 units with a weekly replenishment in order to make themselves comfortable pulling the trigger. However, many buyers are “waiting” for more, even if the properties they are seeing check the boxes. The thought for many is that the more they’ll see, they’ll be more confident in that the one they pick is “worth it”. The danger with this tactic is that our market is changing rapidly and I personally think we are tip-toping away from a buyers market. Also, what often happens is that buyers pass up something during this phase, realize in time that it was the best they had and maybe will see, then spend time chasing this property, forever comparing other properties to it and sometimes hold it on an undue pedestal.

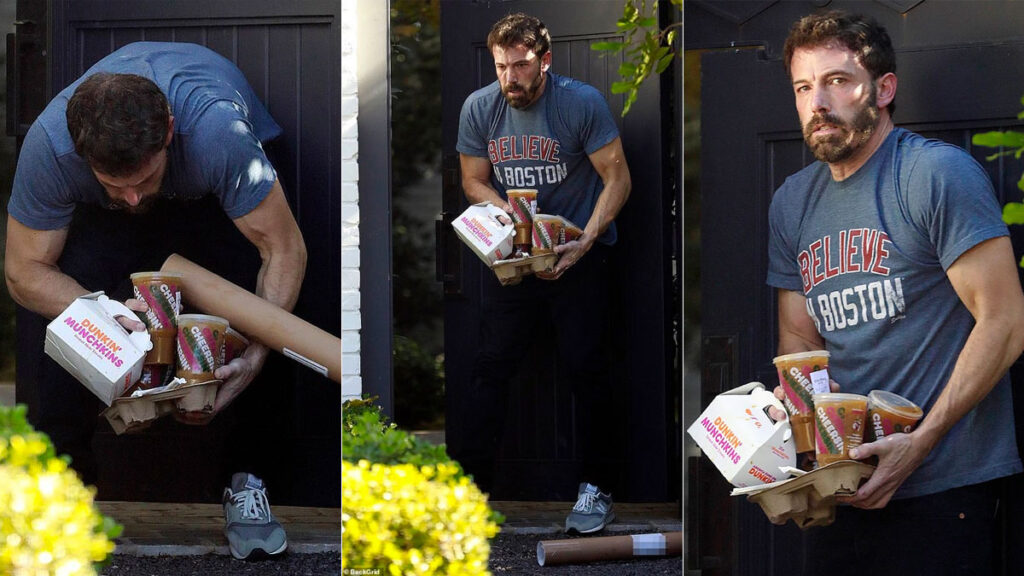

Sellers right now are trying to time their entry like a careful game of double dutch. They’re probably reading the news a bit too literally, are watching the market to see what’s being listed and how long it’s taking to move, and are also trying to time their own entry for the exact moment when rates drop but inventory is still slim. Excessive time on the market is just as much of a killer as being a seller in an inventory heavy market so I entirely understand trying to find the sweet spot but viewing the market this hyperbolically is going to do more harm than good. While some sellers are stuck because they have nothing to buy (and need somewhere to live), many are (if you can visualize this) watching two people swing a jump rope, and leaning in with every turn but not making the jump and resetting themselves for the next swing. Repetitively.

How Buyers and Sellers Can Find Opportunities

It is the opinion of many that the lowest prices of this “market readjustment” were in late fall of 2022. While I’m sure many of you have blacked it out of your mind (and rightfully so), it was a bleak time with low confidence in the market but those who ignored the cacophony of naysayers and purchased are going to do quite well.

While it is not as skewed as it was 6 months ago and rates are still high, the market is still leaning towards buyers. Buyers who are able to stomach the additional financial ask of a higher interest rate are in a position to capitalize on scoring in a lower purchase price in exchange. The game plan for many is to capitalize on favorable pricing now then remedy the interest rate by refinancing when rates return to earth in the coming years. Competition hasn’t fully returned so buyers are able to engage properties without the same fear of every listing ending in a bidding war over ask. However, when rates drop, the pendulum will begin to swing back. In the interim though, carrying a higher interest rate for a year or two can land you a property for a better price without giving up your first born in the process. Buyers shouldn’t be waiting for other buyers to buy in order to reassure their entry to the market; this is the mistake a lot of buyers made going into 2021 – waiting too long for confidence from following contemporaries.

When it comes to sellers, it really is neighborhood dependent. Some neighborhoods, like Soho and Brooklyn Heights, are still being snatched up quickly upon coming to market, usually in a bidding war. Others have been more sluggish, mainly because the ratio of inventory to ready-to-act buyers has not been favorable to sellers. However buyers are starting to see the pace pick up as inventory is moving and best and finals are starting to reappear so this should be encouraging to sellers who would like to sell because we’re quickly approaching that fine window of renewed urgency with steadily low inventory. When buyers start to realize other buyers are buying, this is going to spark the competition and action that sellers have been waiting for. For people who want to trade up, it’s going to be remarkably hard to time selling during a time of low inventory and buying a time of high inventory, while getting yourself favorable pricing on both sides. There is huge opportunity in the trade up market from a price perspective, but akin to the buyer sentiment above, you have to find future comfort in refinancing.

So What Might the Future Bring?

To beat a dead horse into the ground, we’ve been in an almost suffocatingly lean market for about a year and a half now where there is such low inventory and very little turnover. Candidly, I don’t see us having a meaningful uptick in inventory until interest rates considerably drop, which will prompt more buyer activity as there are a lot of people waiting in the wings (which will heighten competition and future propel prices upward). I personally think we’re going to continue to see the same trickle of listings onto the market until the summer time, which is when many hypothesize we’ll finally start to see rates decide to be less sassy. But as far as when properties come to market, no one is planning the market around quarters or vacations or holidays anymore. When push comes to shove, if people need to sell, they’ll sell and if buyers need to buy, they’ll buy so we will always have inventory and movement. But for anyone who has time on their side, they’ll either wait for whenever economically makes sense or if they find themself in position where time is no longer a luxury, they’ll enter the market and play the cards at hand. Waiting until the market gets more inventory is now a gambler’s game; the tactic is more so to play to whatever current market you’re in for opportunities because it’s becoming difficult to predict 3-6-9 months down the road.

To Wrap Everything up With a Warren Buffet Hot Take

“All things considered, the third best investment I ever made was the purchase of my home, though I would have made far more money had I instead rented and used the purchase money to buy stocks. (The two best investments were wedding rings.)” – Warren Buffet. An important reminder that a house isn’t just a financial investment, but an emotional one as well. Buying a home enables you to create stability for yourself and your loved ones, as well as to hopefully build wealth over time when you pay down your loan and your property appreciates in value. Because of both the financial and emotional benefits, Buffett made clear that “Home ownership makes sense for most Americans”. So whatever the market, it’s so easy to look at the purchase hyper-rationally, relentlessly pour over every number, and overthink the future. There is opportunity in every market and real estate in New York is one of the safest markets in the country so remember that the excitement of the sentiment of your “home” should try to be maintained no matter how deafening the news chatter.